Content

Notably, when hospitals receive payment from insurers, those funds are usually only a portion of the value of the services rendered, leaving the rest as receivable. It’s also common for payers to have their own fee schedules, meaning accountants regularly face the complexity of keeping track of a huge web of different billings, receivables, and allowances. Outsourced accounting services are significantly cheaper for a medical office due to savings on accountant salaries and office costs.

It might be appropriate to bulk bill your patients in some situations, but you need to have strict criteria and policies for this type of billing. Reviewing your fees can ensure that your practice maintains a higher level of profitability. Put another way, whether or not a patient is satisfied with a particular healthcare provider can impact his or her treatment outcome. It can also be a deciding factor in whether to file a claim against the company if things don’t turn out as expected.

Accounting for Health Care Organizations

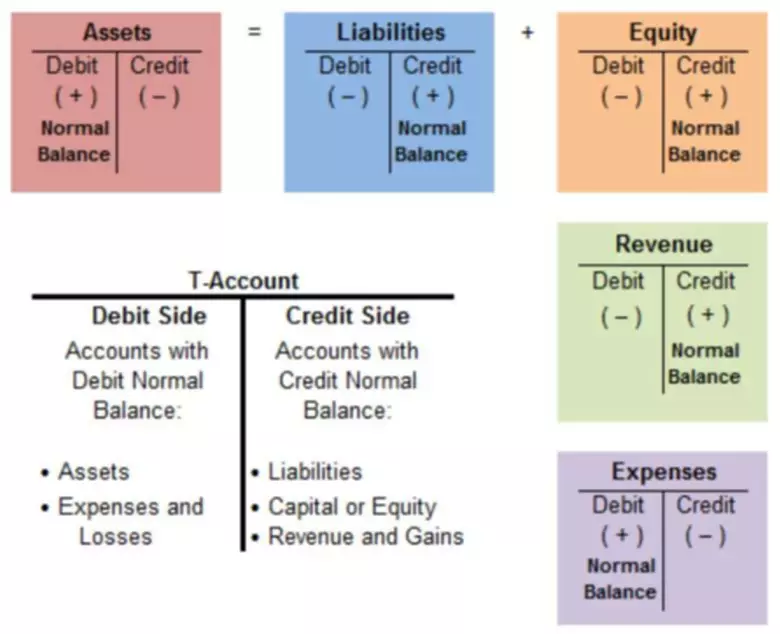

The billing system will allow you to easily control the debits of the amounts that you have charged and collected in a month, as well as any other debits. You will need accounting software to manage the number of clients and transactions your medical practice requires. You need an accountant to manage your medical office payments and perform critical tasks. It might not be the best use case for your administrative staff to perform important financial operations such as payroll. Generally, the most significant medical practice accounting challenges stem from the healthcare billing process. Most businesses provide a product or service to a customer, then receive a predictable payment from them in exchange.

Doctors often provide services and go without the corresponding revenues for months, if they ever receive them at all. When you accurately manage your books, you can keep an eye on the health of your medical practice. If you want to know the pulse of your business, make sure to create a schedule for profit and loss statements.

We Provide Cost-Effective Bookkeeping Services for Medical Companies

Most health care providers are paid by a mix of public and private entities. At a large hospital, accountants may recognize revenue from hundreds of different payers. The portion of revenue from each type of payer is critical to hospital profitability.

Some medical office assistants in bigger medical practices may be the designated appointment scheduler. They may also need to confirm or re-schedule appointments with patients by phone or mail. When it comes to what providers actually charge these payers, transparency is a major concern and one in which accountants are often involved. Some hospitals use a chargemaster, fee-for-service list, or bundled set of payments like MS-DRGs to determine prices. These methods are all complex systems designed to link the financing of services to how they’re paid for.

Bookkeeping in the Medical Office: How to Help Profitability

All medical industry businesses and professional medical practices need well-maintained financial books. In this article, our bookkeepers for medical practices provide an overview of medical bookkeeping and explain how an accounting professional can help support your business. If you are extremely busy, you will want to have someone look at your books. However, if you don’t spend time on your finances, your practice might not increase its profitability. Don’t forget that professional accounting services can save you time and money.

Is QuickBooks considered bookkeeping?

Yes! QuickBooks Live Bookkeeping is an online bookkeeping service that connects small businesses with trusted, QuickBooks-certified virtual bookkeepers. Your bookkeeper takes the lead on your bookkeeping and runs essential reports so you can focus on your business.

It involves creating budgets for your expected costs, comparing them to your actual numbers, and investigating the differences. Here are some best practices you can implement to optimize your accounting function and minimize the time you have to spend managing it. If you’ve ever forgotten to record a payment you made from your checking account, accounting for medical practices you’ve already experienced the angst that having erroneous accounts can cost. On a personal level, they can lead to overdraft charges, utilities being shut down short-term, and a little bit of shame as you call your creditors and explain what happened. To make this concept easier to understand, imagine that you own a store that sells furniture.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Most healthcare providers use cash basis accounting to manage and track their financials. Not only is it easier to use than the accrual method, but it’s also the preferred method for reporting profits on income tax returns because the business can avoid paying taxes on revenue it hasn’t actually received yet. When considering the best way to handle bookkeeping for medical practices, it’s important to weigh the cost vs. benefit.

Of course, labor is expensive, and you shouldn’t waste money unnecessarily. Fortunately, you don’t need to hire full-time workers for all your accounting functions. The many years you spent in medical school were highly effective at preparing you to assist your patients. Unfortunately, they probably didn’t do as good a job of teaching you how to be a business owner.